SINCE 2016

HAIR STYLES D.C

"Presented as one of key external environment forces affecting a whole industry, transcendent economic variables such as interest rate, income declines, demand of goods, dollar trends, money inflation, petroleum prices, among others present a direct impact on the potential attractiveness of organization´s strategies within the industry."

SHIFT TO A SERVICE ECONOMY IN COLOMBIA

INTEREST RATES

“The interest rate is the price of money in the financial markets. As with the price of any other good, when there is more money the rate goes down and when there is a shortage the rate goes up.”

Interest rates increase in times of inlfation, greater demand for credit or due to higher reserve requirements for banks. If any of these grounds occurs, the interest rate tends to despond business activity (because credit become more expensive); on the other hand when interest rates decrease the buyers in the financial markets requesting more loans and sellers removed their savings.

The Board of Directors of Banco de la República decided to increase the benchmark interest rate by 25 bp to 6.0%. In synthesis, increases in food prices and further increases in the exchange rate, related largely to the fall in the price of oil, continue exerting inflationary pressures.

“Interest Rate in Colombia averaged 8.78 percent from 1998 until 2016, reaching an all time high of 32 percent in May of 1998 and a record low of 3 percent in May of 2010.”

According to the magazine “Dinero” the interest rate had an increased of 1,50%, passing of 5,75% to 6,00%with a span of 4 months.

Taken from:

MONEY MARKET RACE

Global money market rates differ dramatically depending on various factors, including underlying economic fundamentals and confidence in monetary policy. Attractive real rates tend to be related with positive near-term currency strength and are often the result of economic growth and monetary stability. Investing in foreign money markets with high real yields can add yield enhancement in addition to diversification benefits. The chart below uses Global 1-Month Deposit Rates to present the range of yield opportunities available to Global Investment Managers.

The Norway Interbank Deposit Rate and the Johannesburg Interbank Agreed Rate were used to proxy 1-month deposit rates for Norway and South Africa respectively. Each rate is an average of the rates indicated by local and international banks for 1-month deposits in the specified currency.

For Brazil, China, Chile, Colombia, India, Indonesia, Malaysia, Philippines, Russia, South Korea, Taiwan, and Thailand, the implied yields for one-month non-deliverable forward contracts were used to represent the rates and exposures available to Global Investment Managers.

A forward currency contract is an agreement by two parties to transact in currencies at a specific rate on a future date and then cash settle the agreement with a simple exchange of the market value difference between the current market rate and the initial agreed upon rate.

(Global Money Market Rates, 2016)

Taken from:

Despite back-to-back interest rate hikes by Colombia’s central bank, economic growth is accelerating with inflation within targets, reported US news service Bloomberg.

The board of Colombia’s central bank, Banco de la Republica, voted unanimously on Friday to cut back stimulus and increase their key interest rate to 3.75%.

Central bank rate hikes generally make it more expensive to borrow money and this usually means people are less likely to spend freely. This consequently limits the rate of inflation, the increase in price of goods and services over time. (Nachiappan, 2014)

Taken from:

FEDERAL GOVERMENT BUDGET DEFICIT

Colombia recorded a Government Budget deficit of 2.40 percent of the country's Gross Domestic Product in 2014. Government Budget in Colombia averaged -3.63 percent of GDP from 2001 until 2014, reaching an all-time high of 0.23 percent of GDP in 2005 and a record low of -8.47 percent of GDP in 2004. As we can find on (economics, 2016)

Taken from:

-

Economics, t. (2016, march). tranding economics . Retrieved march 2016, from trandindg economics : http://www.tradingeconomics.com/colombia/government-budget

Its trends are

2014 -2.4

2013 -2.41

2012 -2.45

2011 -2.9

2010 - 3.9

2009 -2.7

2008 - 2.11

2007 -1.79

2006 -3.4

To see how is Colombia doing with their government budget deficit we also consult other source that is not going to say exactly the same we found before but it show us that Colombia’s government deficit budget has been decreasing.

Taken from:

But that percentage could increase to 3% on the year 2015 as we found on to (portafolio.co, 2015)

taken from:

portafolio.co. (2015, june 12). portafolio.co. Retrieved june 12, 2015, from portafolio.co: http://www.portafolio.co/economia/deficit-fiscal-colombia-2015-cardenas-ministerio-hacienda

AVAILABILITY OF CREDIT

The Colombian financial system had its most important phase of growth between 1991 and 1997, coinciding with the growth of the economy and the strong inflow of foreign capital. In 1995 for example domestic credit increased by 20% in real terms.

Credit availability affects significantly the real and financial decisions of firms. We find that firm investment is highly responsive to the supply of credit, but we don’t find an impact on the sales of firms. We find, however, that it affects significantly the earnings of the firm. This suggest that fluctuations of credit affect the efficiency of the firms; for instance less credit may force to get credit from suppliers at a higher cost. Credit - also modifies the financial management of firms; credit availability to the firm increases lending to its customers and allows the firm to run a higher inventory.(Bustos, 2014)

Take from:

LEVEL OF DISPOSABLE INCOME

Taken from:

-

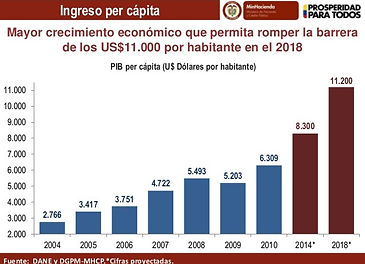

http://www.tradingeconomics.com/colombia/gdp. As we can find on (minhacienda, 2014)Colombia is on a middle-high level of income and also could duplicate its income in 10 years

Taken from:

-

http://data.worldbank.org/country/colombia we found that Colombia is got a upper middle level of income so they are able to not just satisfy their basic needs but also more kind of services, like on our case a haircut, and do it regularly.

Also we found that the poverty head count ration has been decreasing, from 37,2% in 2010, to 34,1% on 2011, to 32,7% on 2012, to 30,6% on 2013, to 28,5% on 2014 and keep decreasing on 2015 also found on

INFLATION RATES

Annual consumer inflation rose in September and it stood at 5.35%. The average of the four core inflation indicators also rose and It reached 4.89%. Transmission depreciation nominal consumer prices, increased costs of imported raw materials and Lower growth in the supply of food explained much of the acceleration in inflation so far this the year (Figure A).Projections suggest that the technical equipment at the end 2015 inflation will be above thecurrent figure, which in the first half of 2016 will remain at these levels and then begin to convergethe target of 3.0%. The transfer of part of the depreciation weight to consumer prices and an El Niño make strong slower the process of convergence to the target, both because of its direct impact on prices and inflation expectations, for possible activation mechanisms indexing.

In November the annual inflation stood at 6.39 percent, above analysts' forecasts, and so far this year accumulated 6.11 percent, well above the 3.38 in the same period of 2014.

Both November and so far this year, accelerating the indicator for the behavior of food prices and tradables excluding food and regulated explains.Thus, the annual CPI regulated increased 3.14 percent in October to 3.66 in November.

Taken from:

WORKER RODUCTIVITY LEVELS

The 2015 Human Development Report (HDR) Work for Human Development examines the intrinsic relationship between work and human development. Work, which is a broader concept than jobs or employment, can be a means of contributing to the public good, reducing inequality, securing livelihoods and empowering individuals. Work allows people to participate in the society and provides them a sense of dignity and worth. In addition, work that involves caring for others or voluntarism builds social cohesion and strengthens bonds within families and communities.

These are all essential aspects of human development. But a positive link between work and human development is not automatic. The link can be broken in cases of exploitative and hazardous conditions, where labour rights are not guaranteed or protected, where social protection measures are not in place, and when unequal opportunities and work related discrimination increase and perpetuate socioeconomic inequality. (Development, 2015)

Taken from:

PROPENSITY OF PEOPLE TO SPEND

Consumption accounts for over 70% of the Colombian economy and consumer behaviour today is the critical point in the overall economic performance, it can be the element that determines which way the balance will tip the economy. Colombia has strengths to face the current global crisis such as the soundness of its financial system, and also has unquestionable weaknesses such as the fiscal deficit. The strength of consumption,however, is an uncertain issue. If consumers respond, the economy could limit damage and protect this crisis.The figures also show an increase in household debt.

http://www.dinero.com/caratula/edicion-impresa/articulo/en-gastan-colombianos/70833

FOREIGN COUNTRIES ECONOMIC CONDITIONS

All the conditions for foreign countries could affect companies of services industry taking into account the low labor price, investment in services, and in other cases when countries have barriers to promote or do those investment (don't flow of trading).

TAX RATES

Taxes are a huge parte of the economy and also of the decision of starting of finishing a business for that reason before entering a new business the companies should take into account the taxes rates, because if you don’t do it carefully you could be paying a big amount of money for not paying them, so we have here a chart that can help to know them in colombia

We also found that Colombia’s tax rate have been decreasing the latest years, as we can see on the next chart:

We can see that is considerable lower that other years and also is the lowest on the history in colombia so that could be good for the companies in colombia.

Added to this the personal income tax also has been stable for a cuple years and being also the lowest rate in the history is a good way to have benefits from the government as we can see in the chart next

VALUE OF COLOMBIAN PESO IN WORLD MARKETS

As we can read on

The Colombian peso is valued as 0,0003000 us dollars, 0,000276 euros, 0,001974 china Yuan and 0,04 japan yens

in the next chart we are going to show is the us dollar been behaving from 2007 to 2015 to have an idea to how the most used currenci in the world have been acting to determina or have an aproximation of how is going to be the nexts years in economic terms at least.

INCOME DIFFERENCES BY REGION

The DXY increased 0.069 or 0.07% to 96.74 on Tuesday February 9 from 96.68 in the previous trading session. Looking back, the DXY gained 2.294 or 2.43 percent during the last 12 months from 94.45 in February of 2015. Historically, the United States Dollar reached an all time high of 164.72 in February of 1985 and a record low of 71.32 in April of 2008

taken from :

http://www.tradingeconomics.com/united-states/currency

As we read on (semana, 2014) we found that 3 regions are responsible for more of the 50 percent of the whole country income with bogota being the most important one as the 24,4%,atlantico the 3,7%, antoquia the 13 %, bolivar the 4,2%, choco 0,5%, Santander 7,6%, Arauca 2,3%, Cundinamarca the 4,9%, meta 5,7%, valle 9,4% and the mazonas the 0,1%.

taken from :

semana, r. (2014, octover 19). revista semana. Retrieved octover 19, 2013, from revista semana : http://www.semana.com/economia/articulo/crecimiento-economico-departamentos/361568-3

CONSUMPTION PATTERNS

FISCAL POLICIES

Colombia, once a model of fiscal discipline for other Latin American nations, has seen its fiscal situation deteriorate since the early 1990s. Higher government spending, taxes that did not keep pace with expenditures, and severe recession led to an unsustainable debt-to-GDP ratio of 52 percent in 2002. Short-term tax increases, even coupled with spending reforms, have not restored Colombia to fiscal balance. A Colombian government commission charged with researching more long-term tax and fiscal reforms gave rise to the selected essays included in this book, each coauthored by Colombian and North American public finance experts. The analyses and recommendations have particular policy relevance for developing economies in general.The studies include both broad discussions of Colombian fiscal and tax systems and detailed analyses of such specific tax instruments as the payroll tax, value-added tax, and the bank debit tax. The focus is on three key concerns: the sustainability of Colombia's fiscal situation, possible reforms to the national tax system, and the fiscal relationship between the national and subnational governments. The theme that emerges from these studies—the importance of moving toward a more efficient and equitable tax system while also raising revenue—suggests the limitations of stopgap measures and the real need for long-term fiscal reform.

(MIT press , 2016)

https://mitpress.mit.edu/books/fiscal-reform-colombia

Monetary and fiscal policies supported growth in 2013. The central bank held

The policy interest rate constant at 3.25 percent between April 2013 and April 2014 and the reallocation of central government spending provided targeted stimulus. Since April 2014, the central bank increased the policy rate by 50 basis points in light of a pickup in growth and inflation. Going forward, the authorities are committed to adjust the policy rate as necessary as conditions warrant keeping inflation within the target range, to adhere to fiscal plans consistent with the medium-term fiscal framework, and to use the flexible exchange rate as a shock absorber.

(FUND, 2014 )

https://www.imf.org/external/pubs/ft/scr/2014/cr14172.pdf

Taken from (economics, http://www.tradingeconomics.com/colombia/personal-income-tax-rate, 2016)

According to the earth negotiations bulletin (ENB) says: “Colombia stated that any change in the consumption and production patterns of industrialized countries must not have an adverse impact on the prospects for developing countries. He called for trade and technology transfer to be connected to any change in production and consumption patterns. Regarding the inferred recommendation from the Secretary-General's report that greater attention must be given to consumer decisions, he stressed producer decisions over consumer decisions. He called for the involvement of exporters, especially in developing countries, in decisions on worldwide standards of production and consumption.”

http://www.iisd.ca/vol05/0545003e.html

EXPORT OF LABOR AND CAPITAL FROM COLOMBIA

The Colombian labor force is among the most skilled and competitive worldwide. More than half the population is under 25.

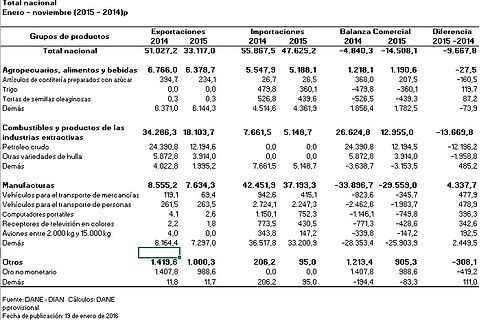

According to the table we can see that the export of labor in Colombia is more than the import, thanks to this the colombian labor force its being more competitive with more knowledge. This situation is helping the country and the economic of these, because at long term we won't need exterior labor force.

ORGANIZATION OF PETROLEUM EXPORTING COUNTRIES (OPEC) POLICIES

“An organization consisting of the world's major oil-exporting nations. The Organization of Petroleum Exporting Countries (OPEC) was founded in 1960 to coordinate the petroleum policies of its members, and to provide member states with technical and economic aid. OPEC is a cartel that aims to manage the supply of oil in an effort to set the price of oil on the world market, in order to avoid fluctuations that might affect the economies of both producing and purchasing countries.”

T

his organization unify and coordinate the petroleum policies for all the members to secure and establish the oil market. His actions affects the world economy (every country) because they establish the basket oil price (one of the most important resources for the world economy).

1. http://www.opec.org/opec_web/en/about_us/23.htm

2. http://www.investopedia.com/terms/o/opec.asp

IMPORT/EXPORT FACTORS

IMPORT

Foreign purchases of the country fell 20.8% in November 2015 compared to the same month last year, from US $ 5,354.3 million in 2014 CIF to CIF US $ 4,243.0 million in 2015.

This behavior is mainly explained by the fall of 22.8% in the manufacturing, 24.6% in the group of fuels and mining products industries and 65.8% in the "other sectors". Group imports of manufactures rose from US $ 4,250.3 million in November 2014 to US $ 3,281.2 million in the same month of 2015. The largest contribution to this result made purchases of road vehicles with -42.9% , machinery and industrial equipment in general with -37.4%, machinery specialized for particular industries -43.3%, other transport equipment with -27.9% and organic chemicals with -34.1%, which together They contributed -14.7 percentage points.

EXPORT

In December 2015 the external sales decreased 32.5% compared to the same month in 2014, from US $ 3.768,1 million FOB FOB US $ 2.543,0 million.

This month exports of fuels and mining products industries registered a fall of 46.8%, which is mainly explained by lower sales of petroleum, petroleum products and related products -49.3% and coal, coke and briquettes -38.7%, which together contributed -44.8 percentage points to the variation of the group. The group's exports of manufactured goods decreased 13.0%, mainly due to falling exports of ferronickel at -50.3%; Essential oils and resinoids at -23.2%; Miscellaneous manufactured articles -26.6%; and fertilizers -82.6%. The four contributed together with -7.8 percentage points.

DEMAND SHIFTS FOR DIFFERENTE CATEGORIES OF GOODS AND SERVICES

The demand curve is a graphical representation of an economic agent's willingness to purchase a given quantity of a good or service at a specific price based on preferences, income, and other prevailing factors at a given point in time. Demand curves in combination with supply curves, which depict the price to quantity relationship of producers, are a representation of the goods and services market. Where the two curves intersect is market equilibrium, the price to quantity relationship where demand and supply are equal.

Source: Boundless. “Changes in Demand and Shifts in the Demand Curve.” Boundless Economics. Boundless, 21 Jul. 2015. Retrieved 08 Feb. 2016 from https://www.boundless.com/economics/textbooks/boundless-economics-textbook/introducing-supply-and-demand-3/demand-46/changes-in-demand-and-shifts-in-the-demand-curve-173-12271

GROSS DOMESTIC PODUCT TREND

The Gross product have been declined in the last year because of the devaluation of the colombian coin in front of the dollar and also the crisis of the petroleum. The increment of the dollar has bring the import products more expensive, so the colombian people buy another products or look forward low prices on sustitute products. Affecting the range of the GDP in a decreasing way.

http://www.dane.gov.co/index.php/cuentas-economicas/cuentas-trimestrales

http://www.dane.gov.co/files/investigaciones/boletines/pib/cp_PIB_IIItrim15_oferta_demanda.pdf

http://www.portafolio.co/economia/pib-colombia-2015-0

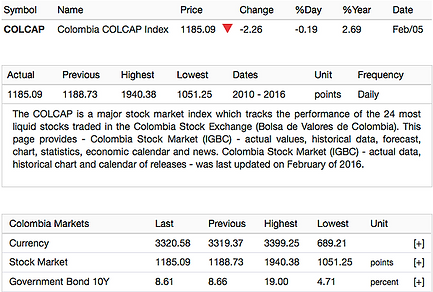

STOCK MARKET TRENDS

The Stock Market trends are referred to those opportunities that companies have and are shown as points in financial factors in order too achieve stability.

Colombia national actions for the year of 2015 were considered as one of the worst investments of the country since they gave negative annual returns. All this was caused by several factors such as the drop in the price of the oil and the value of the dollar rate; so currently betting on shares in Colombia can be considered a problem.

PRICE FLUCTUATIONS

Based on the cense Infocomercio in 2013, made by Servinformación, in Bogotá there are 8.351 Hair Cut places, increasing in 10% comparing with the results since 2010.

Prices changes depending the tendence of the moment but more or less, what influence more is sports games like futbol and other entertaiment events.

Price has been rising 8% more each year.

http://www.eltiempo.com/bogota/el-negocio-de-las-peluquerias-en-bogota/14208735

EUROPEAN ECONOMIC COMUNNITY (ECC) POLICIES

The European Economic Community is an international organization that helps créate economic integration by enabling, the creation of a common market, the establishment of a customs union and the development of common policies.

Therefore, a consequence of these policies, is the free movement of goods, with the elimination of customs obstacles and creating a common tariff, this means that any company in the industry can be installed and could offer their products or services freely throughout Europe.

In addition, companies, do not necessarily have to be settled in the country you want to offer products or services. This brings a good opportunity for companies in the industry to perform business activities in foreign countries.

http://europa.eu/legislation_summaries/institutional_affairs/treaties/treaties_eec_en.htm